We are in a “radically” different bitcoin (BTC) market today, an analyst stressed, while JPMorgan strategists find that decreasing volatility is here to help institutional adoption.

Per the latest Market Intel report by Chainalysis‘ Chief Economist Philip Gradwell, the data collected in the research suggested that the bitcoin price is resilient above at least USD 50,000, that there is significant observed demand at high price levels, but also that the market has changed radically in recent months.

“Cryptocurrency prices have been volatile but resilient over the last two weeks, with the bitcoin price ranging from a low of just over [USD] 50k to a high of just under [USD] 60k, but ending the fortnight at a similar price level to the start, of above [USD] 58k,” he said.

Chainalysis observed the amount of bitcoin held by ‘whales’, those who held at least BTC 1,000, and how much they had paid for it, but they also analyzed all entities holding bitcoin, and concluded that,

“Analyzing the cost of acquisition since 2016 demonstrates how radically the market has changed in the last few months, to one where there is likely to be a lot of demand from existing buyers to support high price levels. As long as existing buyers do not change their hypothesis on bitcoin, it is likely that the price will be resilient above at least [USD] 50k.”

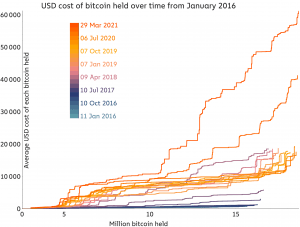

While, by March 29, BTC 8.4m were last acquired for less than USD 10,000 each, BTC 0.1m were acquired for more than USD 57,626 – these holders had made a USD loss but were still holding. Furthermore, said Gradwell, BTC 5.6m were bought for more than USD 30,000 and continue to be held, as well as BTC 3.1m at more than USD 40,000, and BTC 1.6m at more than USD 50,000.

Additionally, with the rapid price increase since November, from USD 15,000 to the all-time high of above USD 61,000, came the significant acquisition of bitcoin across many groups, resulting in the bitcoin cost curve to shift up significantly for 8m of the BTC 18.7m supply – meaning that the cost basis for many BTC is now “radically higher” than just a few months ago, “demonstrating that a broad swath of market participants are willing to buy and hold at much higher prices than previously.”

Cost curves were relatively low in 2016 and early 2017, as the price of BTC had been relatively low. Despite jumping in the meantime, the cost curves changed relatively slowly and remained close together, according to the analyst. But the two most recent cost curves, for January 4 and March 29, have jumped much higher than any in the past and very rapidly.

Antoni Trenchev, Co-Founder and Managing Partner of major crypto lender Nexo, also claims that “bitcoin is showing resilience like no other asset as it enters the rally-inducing part of its four-year economic cycle.”

“It’s totally uninterested in dollar action, Treasury Yields, tech stocks dropping, gold slipping, you name it. With PayPal allowing 29M merchants to accept crypto and Visa effectively becoming an Ethereum layer 2 by adding USDC as a settlement currency, I have no doubt that this bull run is far from over and that we are on track for further BTC support above [USD] 60K,” he said in an emailed comment.

However, as just USD 1.4bn has been spent to acquire BTC 770,000 at more than USD 55,000, Gradwell warns that this is a relatively weaker price level, and that if more dollars are spent to acquire BTC above this price level, then it will likely become firmer, and vice versa.

Volatility decline = stronger interest

Nigel Green, CEO of financial advisory firm deVere, is quoted by The Independent as saying that after a recent epic BTC rally, this momentum has been slowing down and the “temporary bitcoin price slowdown could trigger a new surge in institutional investment, leading to prices going up permanently.”

And this could be helped by the drop in price volatility.

While high BTC price volatility “acts as a headwind towards further institutional adoption,” it has been on the decline in recent weeks, making BTC more appealing to institutions, strategists at JPMorgan said, as reported by Market Insider.

Bloomberg reported the investment bank’s strategists saying that three-month realized volatility has fallen to 86% after rising above 90% in February. The six-month measure appears to be stabilizing at around 73%.

A jump in institutional adoption is “likely to arise from the recent change in the correlation structure of bitcoin relative to traditional asset classes,” which have shifted lower in recent months, the bank explained, “making bitcoin a more attractive option for multi-asset portfolios for diversification point of view and less vulnerable to any further appreciation in the dollar.”

Some of the attention BTC received in the past two quarters has come at the expense of gold, they said, citing USD 7bn of inflows into BTC funds and USD 20bn of outflows from exchange-traded funds tracking gold. “Considering how big the financial investment into gold is, any such crowding out of gold as an ‘alternative’ currency implies big upside for bitcoin over the long term,” JPMorgan said, adding:

“A convergence in volatilities between bitcoin and gold is unlikely to happen quickly and is likely a multi-year process. This implies that the above [USD] 130,000 theoretical bitcoin price target should be considered as a long-term target.”

just setting up my twttr

— jack (@jack)

At 9:01 UTC, BTC is trading at 59,486, having appreciated 1% in a day and 16% in a week. The price is up by 23% in a month and 797% in a year.

____

Learn more:

– Bitcoin to Be Worth Millions by 2023, ETH Above USD 2K by 2022 – Kraken CEO

– Next 2-3 Years ‘Should Be a Turning Point for Bitcoin’ – Deutsche Bank

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

– This Is Why Old Models Don’t Work With Bitcoin According to Raoul Pal

– Bitcoin Is a Sideshow & a Poor Hedge, but It’s Mainstream – JPMorgan