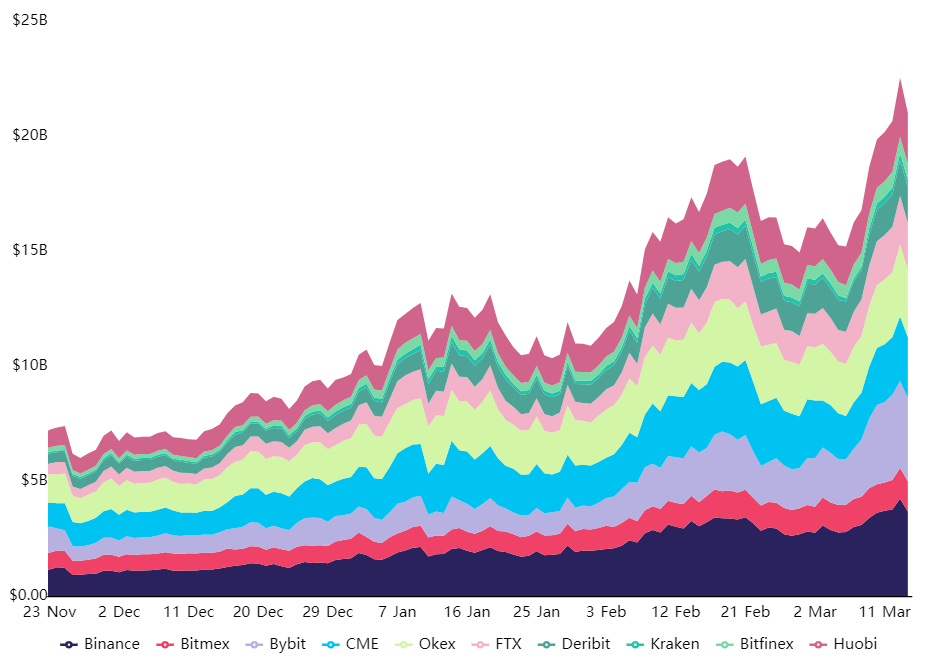

Bitcoin (BTC) price has rallied 22.5% in March, but as the price moved up, some buyers began to use excessive leverage, according to derivatives data. Meanwhile, futures open interest reached a $22.5 billion record-high, causing investors to question how sustainable the current rally is.

Being optimistic, especially during a bullish market, can’t be deemed worrisome. Still, a yellow flag is raised when buyers use excessive leverage because this could lead to large liquidations during a sell-off.

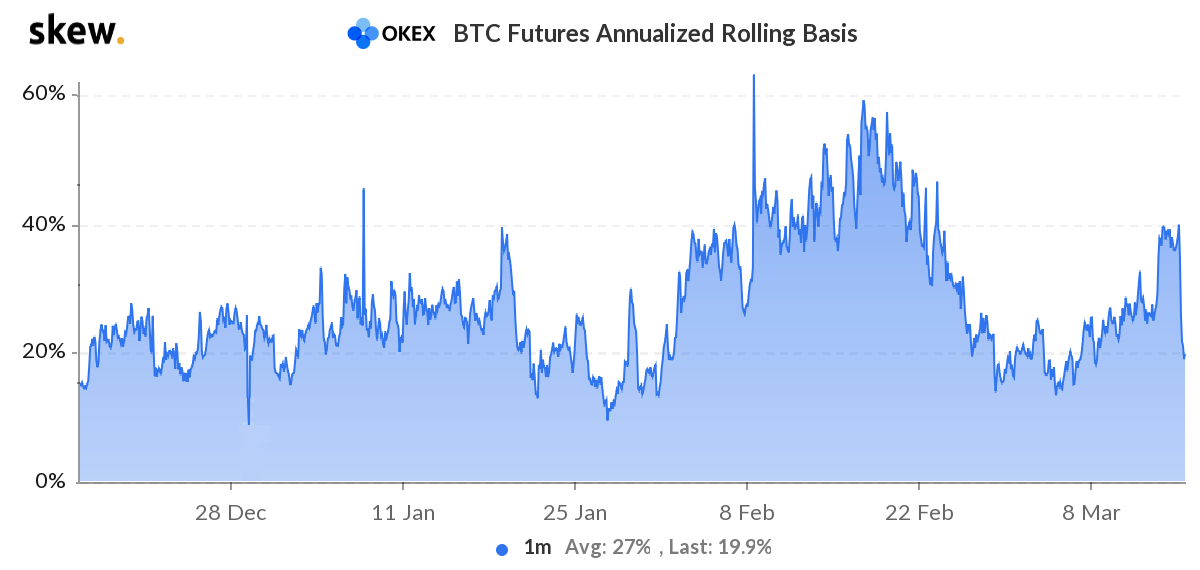

After peaking at $58,300 on Feb. 21, Bitcoin faced a 26% correction over the following week. That move wiped out over $4.5 billion worth of futures contracts, therefore virtually eliminating any excessive buyers’ leverage, which was confirmed by the annualized premium on the 1-month futures contract dropping to 17%.

On March 13 the open interest on BTC futures reached a record $22.5 billion, representing a 39% monthly increase.

To assess whether the market is overly-optimistic, there are a couple of derivatives metrics to review. One is the futures premium (also known as basis), and it measures the price gap between futures contract prices and the regular spot market.

The 1-month futures should usually trade with a 12% to 24% annualized premium, which should be interpreted as a lending rate. By postponing settlement, sellers demand a higher price, and this creates a price difference.

The above chart shows the Bitcoin futures basis peaking at 60%, which is usually unsustainable. A basis rate above 35% signals excessive leverage from buyers and creating the potential for massive liquidations and subsequent market crashes.

Take notice of how this indicator corrected after the BTC price dropped from the $60,000 peak on March 13. A similar movement took place on Feb. 21 as BTC reached a $58,300 all-time high and crashed 22% in less than 48 hours. Meanwhile, the futures basis rate adjusted to a neutral 16% level.

A basis level above 24% is not necessarily a pre-crash alert, but it reflects high leverage usage levels from futures contract buyers. This overconfidence usually poses a greater risk if the market recedes 10% or more from its peak.

It is also worth noting that traders sometimes pump up their leverage during a rally, especially on weekends, but later purchase the underlying asset (spot Bitcoin) to adjust the risk.

The move to $61,750 did not liquidate sellers

Those betting that Bitcoin price will reach $65,000 and above will be pleased to know that open interest has been increasing throughout the 71% rally since February. This situation indicates short-sellers are likely fully hedged, taking benefit of the futures premium instead of effectively expecting a downside.

Using the strategy described above, professional investors are essentially doing cash and carry trades that consist of buying the underlying asset and simultaneously selling futures contracts.

These arbitrage positions usually do not present liquidation risks. Therefore, the current surge in open interest during a strong rally is a positive indicator.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.