Bitcoin’s (BTC) price made another new all-time high above $60,000 over the weekend. However, the same cannot be said for Ether (ETH), and the market in general didn’t show much strength thereafter for a continuation. As a result, BTC price has dropped by 7% over the past 24 hours.

During this pullback, ETH also dropped in its U.S. dollar pair. However, the ETH/BTC pair actually saw a bounce. It could be the case that altcoins are attempting to stabilize against BTC while Bitcoin is paring some of its massive weekend gains. Interestingly enough, could this be a prelude to a potentially massive rally for Ether later this year? Let’s take a look at the charts.

Ether fails to break above $1,900

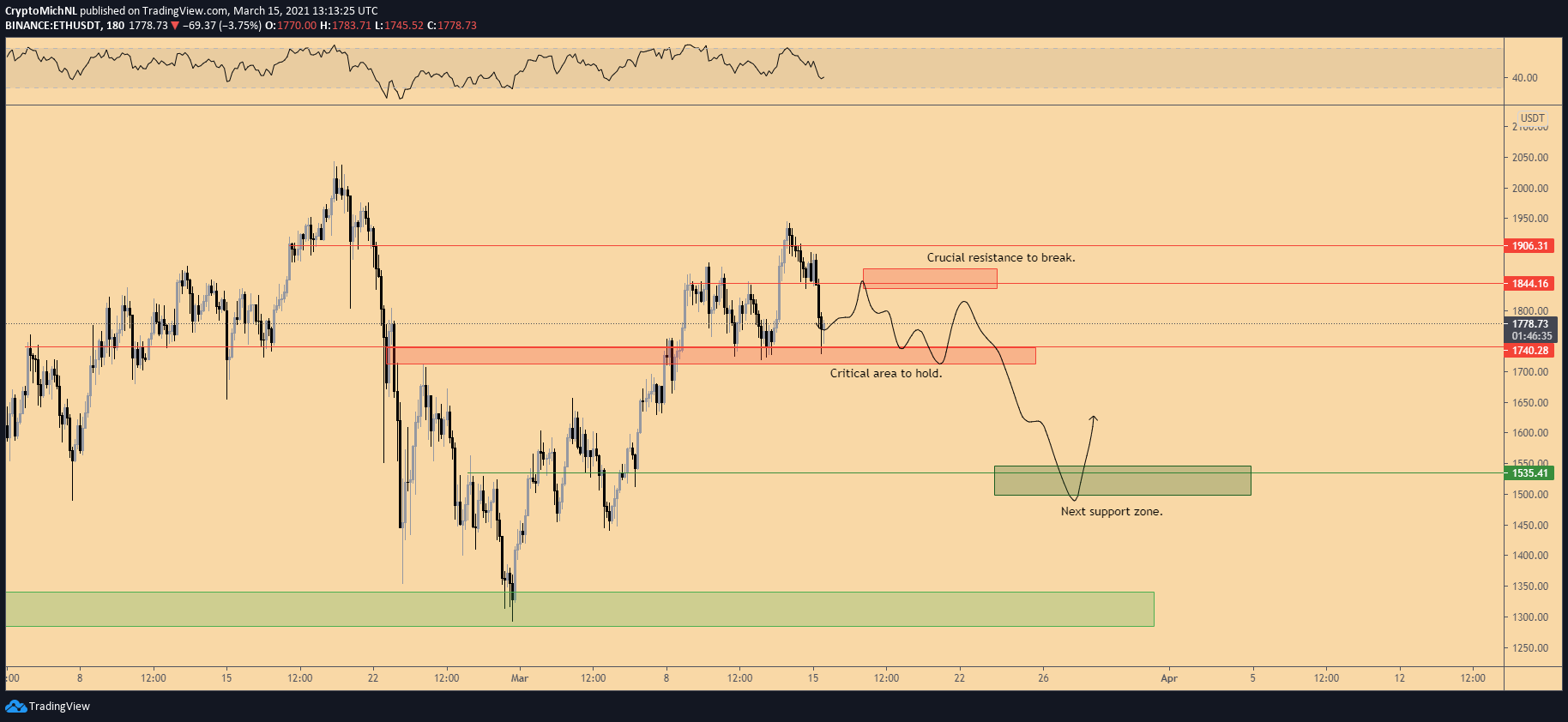

Ether failed to break through $1,900 on March 13, which is essentially the final hurdle before hitting the psychological barrier of $2,000. The entire market is waiting for a clear-cut break above $2,000, and it looks like it has to wait a bit longer.

Since the bottom at $1,300, beautiful support/resistance flips have been seen for more upside. The last support/resistance flip occurred at the $1,740 level, resulting in a rally toward $1,900.

However, Ether’s price came back to this $1,740 level rather quickly. Such a dropdown is a sign of weakness, particularly as multiple tests of key support levels increase the risk of falling further.

In other words, if Ether’s price can’t hold the $1,740 area, the market should expect another leg down toward the $1,500 level.

ETH/BTC holds firm

Luckily for the bulls, the ETH/BTC pair has held up nicely during this latest drop in BTC price, finding support in the 0.029–0.031 sats region. If this support zone is lost, however, the next support is found at the 0.025–0.0275 sats region. This level, in particular, is critical to hold to sustain the current bull market cycle.

Meanwhile, the chart shows that altcoins do not constantly go up. They often experience heavy corrections, and ETH/BTC has already been in correction mode since February.

Nevertheless, the construction itself remains intact and valid, with higher lows and higher highs constantly being printed.

The chart for ETH/BTC still looks bullish. The constant higher lows have been in play since summer 2019, which kickstarted a general uptrend.

Such uptrends do have periods of consolidation. But as long as the structure of higher lows remains, the bullish structure remains valid. Therefore, the regions previously discussed are important to watch, namely the area between 0.025 sats and 0.0275 sats.

A strong impulse move will likely happen for Ether once Ethereum 2.0 is closer to its release date, which should help resolve some of the scaling issues and high transaction costs. Until then, the FUD (fear, uncertainty and doubt) and negativity surrounding the project will likely remain.

However, traders should be aware that times of negative market sentiment are usually the best period to get in, rather than entering, or FOMOing, when the market is overheated.

A possible scenario for Ether price

The critical areas to hold for Ether now are between $1,700 and $1,740. Tests of the resistance levels above should occur as long as this support region remains below. However, the crucial resistance to break is the $1,830–$1,860 level.

However, breaking the $1,830–$1,860 level is unlikely in the short term, given that the market sentiment has shifted in the past few days. If the resistance confirms here, Ether may face another corrective move toward $1,500.

The next big impulse wave could happen once this period of consolidation and compression is completed. This impulse wave should propel Ether far above $2,000. However, patience is key, and investors should understand that developments take time, fundamentally and pricewise.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.