The most basic Bitcoin (BTC) options contracts involve buying a call which gives the holder the opportunity to acquire the asset at a fixed price on a set date. For this privilege, the buyer simply pays an upfront fee, known as a premium, to the contract seller.

Although this is a great way to use leverage while avoiding the liquidation risk that comes from trading futures contracts, it comes at a cost. The options premium will rise during volatile markets, causing the trade to require even further price appreciation to generate a reasonable profit, so the premium is a metric investors must keep a close eye on.

Bitcoin’s daily volatility currently stands at 5.4%, which is far higher than S&P 500’s 1.7%. This creates opportunities for arbitrage desks, which will gladly hold Bitcoins in custody and sell a call option to capture this premium.

Let’s look at a hypothetical trade to what role the premium plays in the scenario.

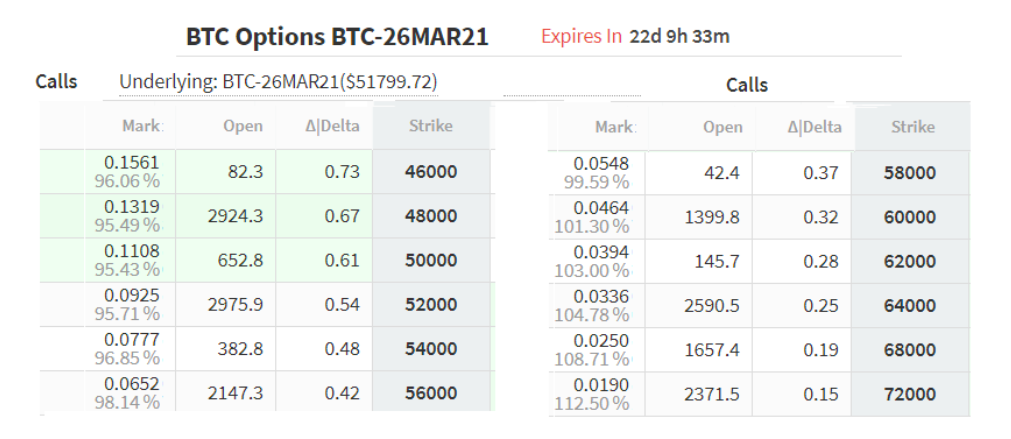

The odds of this trade are calculated according to the Black & Scholes model and Deribit exchange presents this information as ‘delta’. In short, these are the percent-based odds for each strike.

According to the chart above, the $54,000 strike for March 26 has a 48% chance of occurring according to the options pricing model, which sounds reasonable. On the other hand, the $58,000 call option has an implied probability of 37%.

With roughly 20 days left until the March 2021 expiry, the odds of Bitcoin price closing the month above $60,000 seem likely given today’s price action. Considering this call option is trading for BTC 0.0548 each, it costs $2,790 when Bitcoin was trading at $50,900.

In order for this call option to become profitable, BTC price needs to be at $60,800. Had this buyer opted for a conservative 3x leverage futures position, Bitcoin price at $60,800 would have yielded a $1,485 gain.

Option markets are a great way to leverage, but investors must set aside time to carefully analyze returns ahead of buying bullish calls.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.