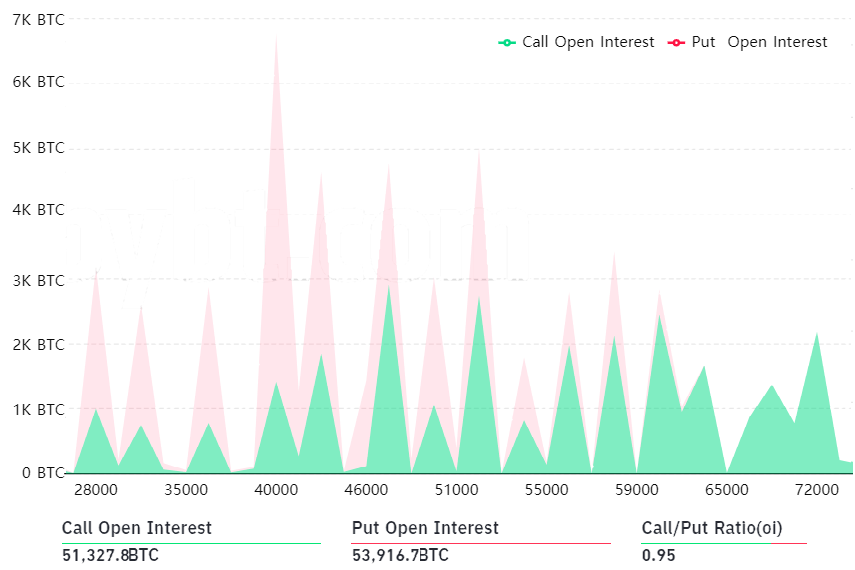

Earlier this week, Cointelegraph reported the importance of the upcoming $6.1 billion Bitcoin (BTC) options expiry on March 26. The article made clear that bulls were in control if one excluded the put (sell) options below $47,000, which is likely the case as BTC currently hovers above $50,000.

As the expiry date draws closer, it’s less likely that traders will be willing to pay for the right to sell BTC at $47,000. The same could be said for the ultra-bullish call (buy) options at $60,000 and above. Therefore, the $6.1 billion total open interest is heavily inflated by worthless options.

Could there be something hidden in BTC options that is causing current pressure on price pressure? To determine this, one needs to analyze how these calls and puts stack below $50,000.

The total open interest slightly increased over the past ten days to 105,000 BTC options. Now that BTC price dropped to $51,500, these are now worth $5.4 billion. As previously mentioned, this is not a fair assessment to make if one excludes the neutral-to-bearish puts below $45,000, which are effectively worthless right now. This data means there are only 11,100 BTC contracts left.

This number translates to a mere $572 million put options open interest, or 20% outstanding. The neutral-to-bullish call options focusing on the $20,000 to $56,000 range result in 20,850 BTC, or $1.07 billion at the current BTC price. This number is almost double that of the competing put options and still leaves bulls in complete control of Friday’s expiry.

Would a drop to $45,000 change the tide?

If Bitcoin price somehow drops to $45,000 at 8:00 UTC on March 26, these 11,100 put options would create further downward pressure. On the other hand, this would be virtually balanced by the 11,050 neutral-to-bullish call options from $20,000 to $44,000. The amount of call (buy) options effectively exercised will match the put (sell) options, creating no imbalance.

Therefore, if the media or analysts are pinpointing $45,000 as a game-changer for short sellers to take control of the options expiry, they’re wrong about it. Undoubtedly some of these call options could have been used in various strategies, thus providing a market-neutral positioning for its holder.

The same rationale could be argued by those holding the neutral-to-bearish put options. Not necessarily because its buyers are cheering for lower Bitcoin prices, but rather the result of holders having also bought futures contracts or sold put options at a slightly higher strike.

What’s possibly behind the current Bitcoin price drop?

The human mind needs narratives, but the market doesn’t always work that way. There have been at least three other fear, uncertainty, and doubt (FUD) events over the past week.

Some of the top ones that come to mind include Ray Dalio’s: “good probability of a U.S. Bitcoin ban” and remarks from Amundi Deputy Chief Investment Officer Vincent Mortier, who suggested that cryptocurrency regulation could cause a “brutal price correction.”

Another supposedly bearish announcement was issued on March 22 when Federal Reserve Chair Jerome Powell stated that “Bitcoin is too volatile to be money” and “is backed by nothing.”

Statements like these usually play some role in curbing investor expectations, but no one can really know what drives each market participant to trade at each price level.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.